This Justice Alito Disclosure Is Fine

The justice still owns too many stocks, but his penchant for controversy was largely absent in his latest disclosure

No international travel, no gifts from European princesses, no book advances and no major changes to his stock portfolio.

Justice Samuel Alito’s 2024 financial disclosure report was posted today in the judiciary’s online database, listing his board appointments, his one reimbursed trip and his financial holdings. In what can be termed as refreshing news, it lacked the intrigue of prior disclosures.

What makes the report noteworthy is that Alito filed it at all. Two years after he told the Wall Street Journal that “[n]o provision in the Constitution gives [Congress] the authority to regulate the Supreme Court—period,” the jurist complied with Congress’ authority under Article I, and carried out in the 1978 Ethics in Government Act, to regulate the Supreme Court. That the report was posted online is thanks to a law Congress passed in 2022.

Disclosure contents:

Alito reported receiving no outside income (he’s likely to list a book advance in a subsequent FDR) or gifts valued at $480 or greater in 2024. Courtwatchers will remember that last year, Alito reported receiving free concert tickets, valued at $900, from German noblewoman Gloria von Thurn und Taxis, who hosts an annual festival on the site of her 500-room palace. Princess TNT, as she’s been called, visited Alito and Justice Kavanaugh at the Supreme Court in 2019 with Brian Brown, the head of the National Organization for Marriage.

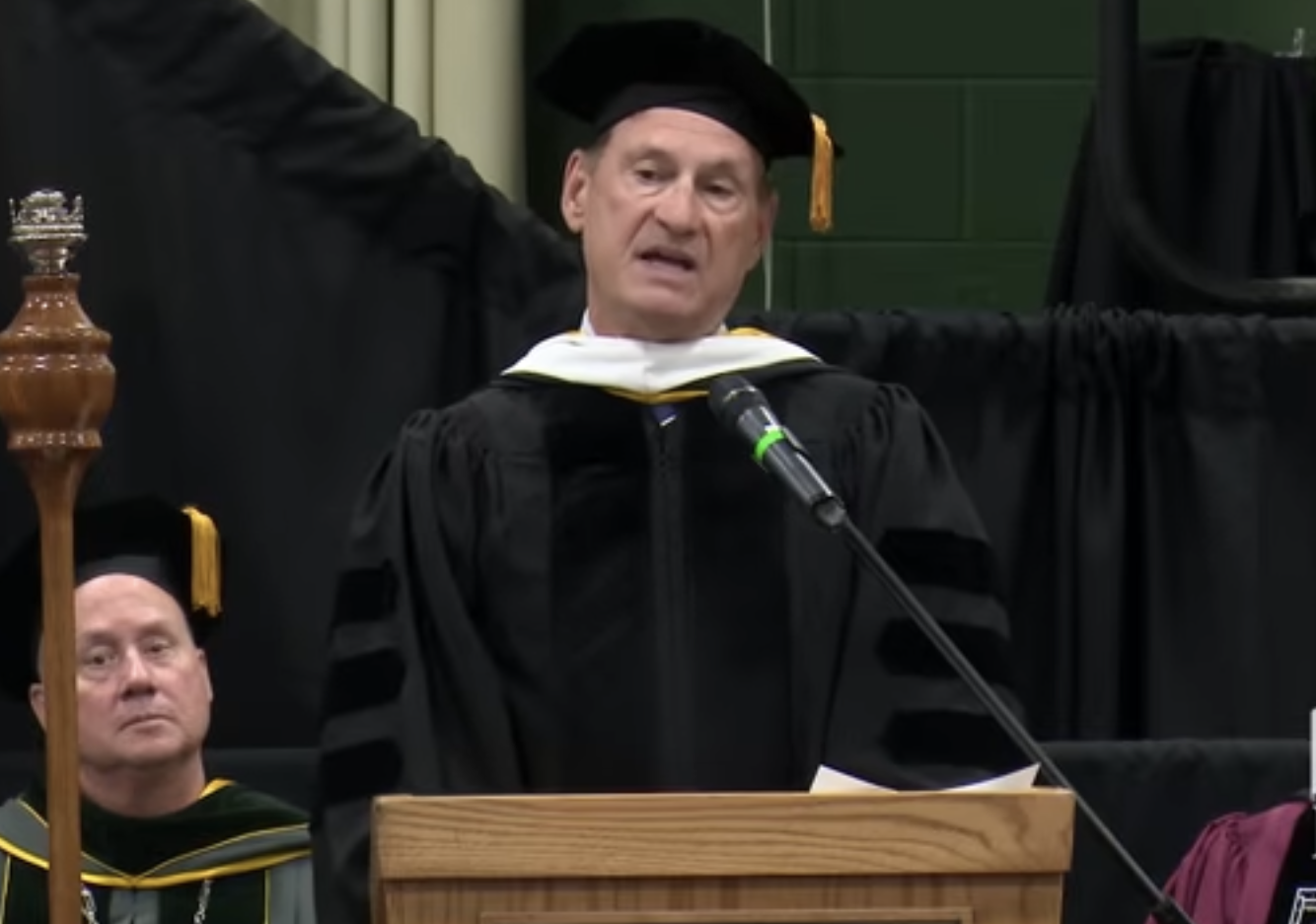

Alito’s sole reimbursement was for a commencement speech at the Franciscan University in Steubenville, Ohio, in May (at right), where he said religious freedom was being “threatened.”

The only other trips Alito took in 2024 that we have on record — identified via Fix the Court FOIA of U.S. Marshals Service documents — were two springtime visits to his New Jersey beach house with his wife, Martha Ann.

Alito reported no new stock purchases in 2024, though he did add shares in two companies, Amentum Holdings and Solventum Corp., due to spinoffs, and he sold all his shares in two companies, Caterpillar (which hasn’t been a named party at SCOTUS in five years; see no. 14) and L’Occitane Luxembourg, which was taken private last October. According to the Supreme Court’s Public Information Office, the periodic transaction reports reflecting those sales have been filed and will be posted to the database in due course.

Alito remains the leader in SCOTUS stock ownership, holding a stake in 28 companies at the end of last year (27 now since he sold his Boeing shares in April). Alito recused in 20 petitions, 19 at the cert. stage and one (22-1079) at the merits stage, due to his stock ownership in 2024. So far in 2025, that number stands at 18: 17 at cert.; one at merits (23-1067). The only other justice to own individual stocks is Chief Justice Roberts, who has shares in two companies, and Roberts’ most recent stock-based recusal occurred in 2021.

“There’s no reason for justices to own stock,” FTC’s Gabe Roth said. “Some recusals are unavoidable, like when the Smithsonian is a party (the Chief Justice sits on the board by law) or when a case from the D.C. Circuit that then-Judges Kavanaugh or Jackson had sat on reappears at SCOTUS. But since the justices are free to own as many mutual funds, bonds and retirement accounts they like, there’s no justification for owning stocks and thereby, via recusal, increasing the likelihood of a 4-4 tie, which belies the point of having a Supreme Court.”

This is the 14th year in a row that Alito opted to take the allowable 90-day extension — though this was just the third time he filed on the 90th day (also in 2012 and 2024 for the 2011 and 2023 FDRs, respectively).