Judicial Conference Issues New Financial Disclosure Rule. Who Benefits?

By Gabe Roth, FTC executive director

On Monday, the Judicial Conference of the U.S. issued a new financial disclosure regulation that included one potentially substantive change as compared to the old version. It comes in this one-sentence addition on personal hospitality on pp. 7-8:

“Note: The reporting exemption applies to stays extended for a nonbusiness purpose at a personal residence of the host, even if the personal residence is owned by an entity, provided that the residence is not regularly rented out to others for a business purpose and there are no indicia that the residence is commercial.”

This language is potentially problematic for several reasons. Say I purchase a property in the northern Virginia woods to build a house but form an LLC with directors and other officers to make the purchase. That means, on the one hand, I am not a “person” who is liable if a tree from my woods falls onto my neighbor’s property and causes damage. The LLC is. But according to the JCUS regs, the Virginia woods LLC is now a “person” who can host a federal judge or justice without him having to report it on his disclosure.

That seems to contradict federal law, which states that “personal hospitality […] means hospitality extended by an individual […] on property or facilities owned by that individual or the individual’s family” — i.e., not the individual’s LLC.

Maybe it’s a distinction without difference, and I’m overstating the case. After all, corporations are “people” under Supreme Court precedent.

But it’s equally likely that what we have here is the Judicial Conference twisting itself into knots to limit Justice Thomas’ liability under the Ethics in Government Act.

Here are some places with corporate ownership where Justice Thomas has received gifts since ascending to the high court:

— Mill Creek Farm (multiple years), owned by CFH Mill Creek Company, L.P., located in East Texas (unsure of corporate structure but Harlan Crow appears to control)

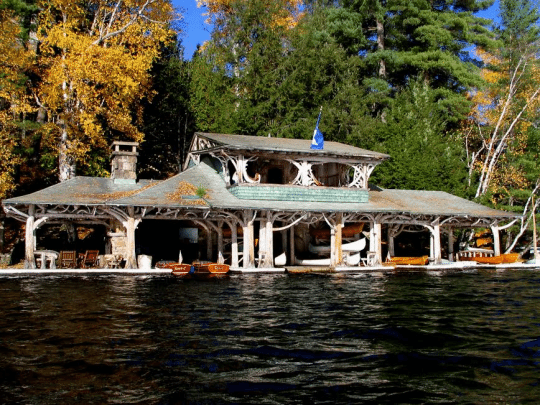

— Camp Topridge (multiple years), owned by Topridge Holdings, LLC, located in Upstate New York (Crow)

— The Michaela Rose (multiple years), owned by Crow Holdings, LLC, docked who knows where now (Crow)

Let’s assume each counts as a “personal residence” of Crow under the regs since Crow spends the night at each over the course of the year, and assume that none (save the Michaela Rose from 2003-15) is rented out to the public.

When Justice Thomas stays for free at these places, does he now get to avail himself of the personal hospitality exemption? Seems like it.

He might have tried to do so previously in some cases but not others — recall there’s no mention of the Michaela Rose on his 2019 “amendments” (p. 6), but there is mention of Topridge on his 2022 FDR (p. 2) — but now the Conference is giving him and his colleagues carte blanche to omit gifts from his disclosures so long as someone they know plays some role in the corporate structure of the resort, ranch or yacht they’re staying at. Not great news for transparency.