Like Scalia, Roberts and Alito Should Sell Their Stocks

By Dylan Hosmer-Quint, FTC research associate

By Dylan Hosmer-Quint, FTC research associate

Former Supreme Court Justice and conservative icon Antonin Scalia has long been touted as the mold for future conservative justices.

Now Fix the Court is asking current conservatives (and one liberal) on the court to follow Scalia’s lead in terms of managing their financial holdings.

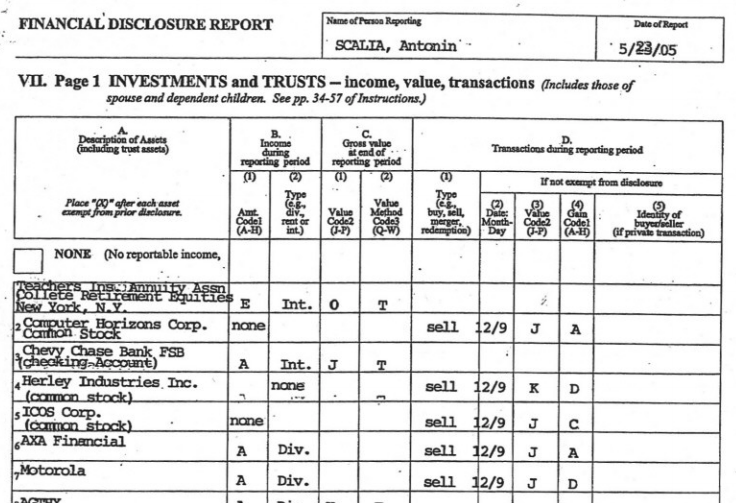

On December 9, 2004, Justice Scalia sold his individual stock holdings in a variety of companies, as you can see from the screenshot of his disclosure report at right. (As far as we can tell, he didn’t own any shares of stock during the rest of his SCOTUS tenure, save some Berkshire Hathaway Class B shares he bought in 2009.)

In contrast, fellow GOP-appointed Justices John Roberts and Sam Alito have held on to their stocks during their tenure on the court. Along with Justice Stephen Breyer, they are the only current justices still in possession of individual stocks holdings. These justices would be well served by following in Scalia’s lead here.

You may recall that 2004 was a turbulent year for Scalia. He faced questions of ethical impropriety after attending a hunting trip with Vice President Dick Cheney just three weeks after granting cert. in an appeal by the Vice President. (Justice Alito faced similar questions last year after meeting with Brian Brown, president of the conservative National Organization for Marriage and frequent amicus filer before the court.)

In fact, the court as a whole has been marred by suspicion of late. A recent poll found that 65 percent of Americans believe that justices bring bias to the cases they hear. The crisis in confidence is no doubt fueled by ethical lapses, ranging from financial conflicts of interest to improper, political meetings.

Facing similar pressures to Scalia, the court’s current justices would do well to follow his footsteps in selling off individual stocks. Stock ownership has caused nothing but trouble for Roberts, Alito and Breyer. In recent years, Fix the Court has regularly found missed recusals, that is, times in which the justices participated in a case despite owning a financial interest in one of the parties.

Judging a case or petition despite a financial conflict is a violation of federal statute, justices’ ethical obligations and the basic tenets of justice that guarantee impartiality.

These missed recusals are notable errors, and they should hardly be necessary. Roberts, Alito and Breyer could, like Scalia, sell off their individual stocks and instead be invested 100 percent in mutual funds, index funds and bonds. Such a choice would foreclose the possibility of an ethical breach.

Over the last few years, the justices have shed about half their stocks in order to avoid recusal. All told, the three owned shares in 40 companies at the end of the 2018, compared to 44 companies at the end of 2017, compared to 50 companies at the end of 2016, 57 companies at the end of 2015 and 73 companies at the end of the 2014.

To take one example, following the death of Alito’s father-in-law, the Alitos in 2013 inherited shares in several publicly traded companies, including, as part of a trust, General Electric shares. Good thing, though, that the assets in that trusted were distributed, according to Alito’s disclosure report, in 2015. Had that not occurred, Alito would have had to recuse from the Jan. 21 arguments involving a GE subsidiary.

A stock-based recusal means an eight-member court, which could yield a 4-4 tie, which means, to paraphrase a famous Justice Kennedy quote, everyone’s time is wasted.

The impartiality of the third branch has been overly strained in recent years. Stock ownership is not the cause, nor would selling stocks remedy the situation entirely. But it would certainly be a welcome development, and a sign that he justices take their ethical obligations and independence seriously.