New Amicus Report Details How the Justices Are Shying Away from Recusal-Inducing Investments

*** Report: http://tinyurl.com/FTCdivestment ***

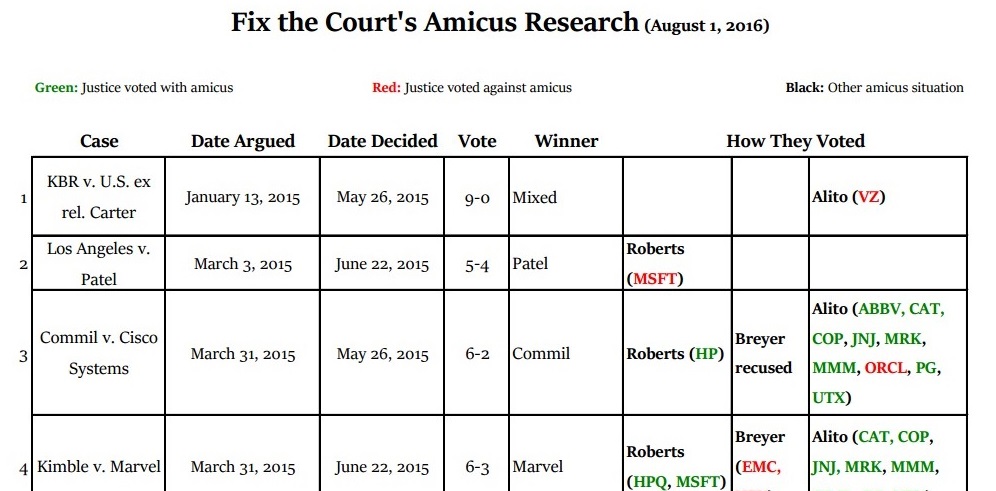

*** Easy-to-Read Chart: http://tinyurl.com/FTCam

In a new report released today, Fix the Court has found that since the start of last year the three justices who own stocks in individual companies have sold up to $1.475 million worth of shares in 15 publicly traded companies, while only investing about $100,000 into four companies.

In a new report released today, Fix the Court has found that since the start of last year the three justices who own stocks in individual companies have sold up to $1.475 million worth of shares in 15 publicly traded companies, while only investing about $100,000 into four companies.

Instead, Chief Justice John Roberts and Justices Stephen Breyer and Samuel Alito seem to be making a concerted effort to focus their investing on financial instruments that would not likely trigger recusals: Roberts bought shares of nine mutual funds in 2015; Breyer purchased three treasury notes and a bond fund; and Alito, who also cashed out a million-plus trust, invested in 21 mixed funds, mostly ETFs and mutual funds. All told, Roberts, Breyer and Alito owned shares in 58 companies at the end of 2015, compared to 76 companies at the end of the 2014.

Fix the Court executive director Gabe Roth said: “Twice last term the justices made errors due to their stock ownership: Breyer heard an energy case despite his wife’s ownership of shares in a litigant, and Roberts did not recuse at the cert. stage from a Superfund case despite his relevant stock ownership. Given these errors and the dozens of time at the cert. stage in which the justices have forfeited their duty to sit due to relatively minor investments, it is not surprising that the three have begun to make a concerted effort to focus on investments that would not trigger recusals.”

Given that these three still own shares in almost five dozen companies, the “amicus problem” that Fix the Court first identified last year remained a problem in 2015, as eight cases at the merits stage included an amicus brief from a company whose shares a justice owned.

Though the numbers are down a bit – from 67.6 percent in 2009-2014 to 43.8 percent in 2015, primarily due the business support of same-sex marriage and affirmative action in Obergefell and Fisher, respectively, and the Roberts and Alito opposition to those positions – overall, the justices have been siding with their amici more than 60 percent of the time since Fix the Court started tracking this phenomenon (2009-2015).

The 2015 cases in which businesses whose shares the justices own submitted amicus briefs are: KBR v. U.S. ex rel. Carter, Los Angeles v. Patel, Commil v. Cisco Systems, Kimble v. Marvel, Obergefell v. Hodges, Tyson Foods v. Bouaphakeo, Spokeo v. Robins and Fisher v. UT-Austin.

Notes from the cases:

– Though Alito voted with KBR, which technically won the case, the court opposed KBR’s (and Verizon’s) interpretation of the False Claims Act in KBR v. U.S. ex rel. Carter.

– Commil and Kimble, both patent cases, included a barrage of business briefs and were the most difficult to characterize, as companies themselves are grappling with the extent to which they want keep their patents strong and valid while still potentially acting on those from other companies that are set to expire. The proliferation of patent trolls, a trend that clearly concerns the court, has only made this issue more complicated – and it doesn’t seem to be going away.

– All of the cases that resulted in a 4-4 tie were decided in 2016, so we will not know the business pull in those until the justices’ 2016 financial disclosure reports are released next summer.